The new IVA Protocol 2025 has now been published by The Insolvency Service and will run in parallel with the 2021 protocol until 1st July 2025 when it will become the IVA protocol that the whole IVA industry is working to.

Key changes and clarification for Insolvency Practitioners (IPs):

- Creation of a new ‘Key facts’ document, which must be given to consumers before they agree the IVA proposal.

- Clearer guidance on when a protocol IVA is not suitable. For example, if the consumer qualifies for a Debt Relief Order (DRO), or where total debt is under £7,000.

- The consumer’s family home will no longer form part of their IVA, although it may impact the length of the IVA.

In addition, there is also clear guidance on additional diligence that should be undertaken when proposing “benefit cases”.

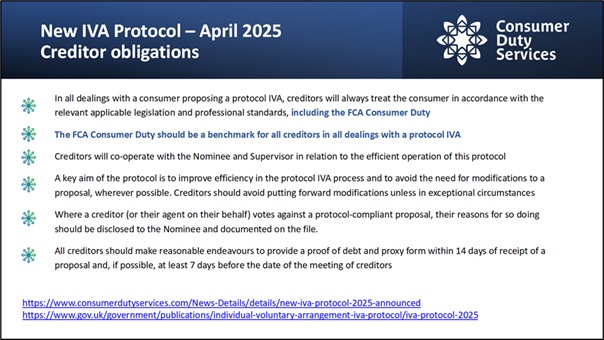

Creditor obligations contained in the new protocol:

Significantly, the new protocol also includes important references to Creditor obligations and provides formal confirmation of what CDS has been telling Creditors since the creditor events which we ran in March 2024 and May 2024. This follows on from the implementation of PS24/2(Borrowers in Financial Difficulty) in November 2024.

“In all dealings with a consumer proposing a protocol IVA, creditors will always treat the consumer in accordance with the relevant applicable legislation and professional standards, including the FCA Consumer Duty.”

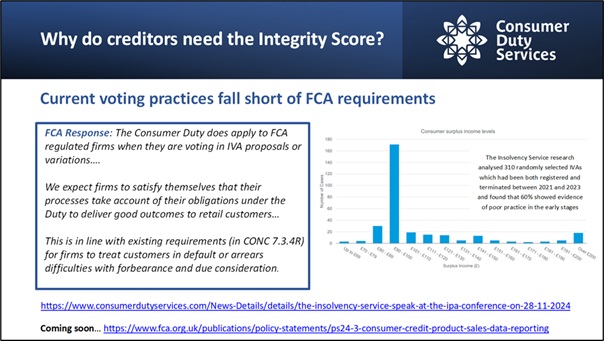

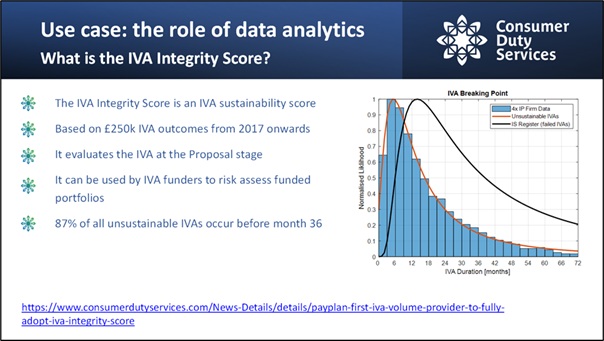

This means that when considering how to vote on a protocol IVA and indeed in respect of any IVA they must consider the consumer outcome at an individual level. That is why we developed our IVA Integrity score to help creditors both discharge and evidence that consideration.

It may be tempting for creditors to disregard these obligations as they are included in a personal insolvency protocol published by The Insolvency Service not the FCA, however, those Creditor Obligations would not have been included in the new protocol without consultation with the FCA. This simply underscores the message the FCA sent out last year in response to a question we asked them directly, as set out below.

Putting the new protocol into context of the regulatory focus

It is important for creditors to appreciate the regulatory context in which the new protocol has been published. When the 2021 protocol was published there was little evidence of any joined-up thinking between the FCA and The Insolvency Service. In 2023/24 we began to see very clear evidence of collaboration and consultation between the two regulators. The Insolvency Service started to specifically reference that collaboration, and their joint focus has never been clearer than today.

In October 2024 the Insolvency service published its finding in respect of its investigation into to early terminations and Claire Hardgrave’s presentation to the IPA conference in November 2024 gave little room for any misunderstanding. IPs needed to do better, too many people were being placed into unsuitable or unsustainable IVAs which were failing and things needed to change.

The FCA is also clearly concerned about too many consumers ending up on inappropriate debt solutions and the poor consumer outcomes that early IVA or DMP failures represent. Creditors and their agents have a key role to play as ‘third line of defence’ in the IVA voting process.

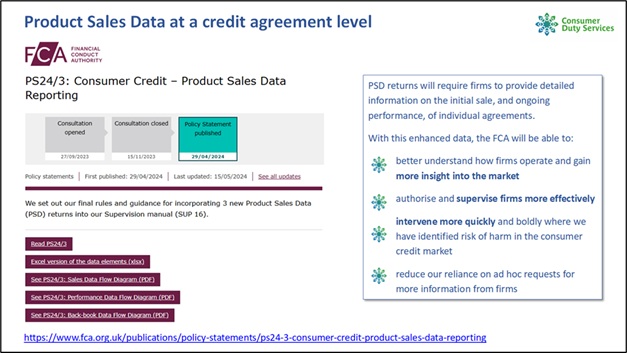

Product Sales Data (PSD)

Product Sales Data (PSD) under PS24/3 is just around the corner, where ‘performance data’ is at a credit agreement level, including cases in IVAs and DMPs. The quality of MI and data-analytics is a key focal point for the regulator ahead of the next round of Duty Board reports in July 2025. It is clear that they have looked at higher risk segments of a customer journey, where financial vulnerability features strongly, including poor consumer outcomes. Financial and non-financial vulnerabilities combined heighten risk, as reflected in the FCA findings on their vulnerability guidance on 7 March 2025.

In much the same way that the FCA has focused on vulnerability management and affordability assessments, the sustainability of debt remedies will come under increasing scrutiny in 2025, whether that be a time-to-pay (TTP) arrangement, an informal debt solution like a DMP or a formal debt solution like an IVA. The consequence and customer treatment following a plan failure will also be closely scrutinised, which may take account of how the creditor voted in the first instance.

Role of the CDS Integrity Score

Introducing the IVA Integrity score into your voting criteria enables creditors to both consider and importantly, evidence that consideration of the likely sustainability of the IVA being proposed, before deciding whether to support or reject the proposal.

Currently too many unsustainable IVAs are being approved and too many sustainable IVAs are being rejected. Our objective is to help creditors to tell the difference and to vote more intelligently and more compliantly.

PayPlan recognised this very early on and supported us at our creditor events and in building the score. This has now been fully operational for over 6 months.

About Consumer Duty Services

Consumer Duty Services or “CDS” was established by subject matter experts Peter Wordsworth and Kevin Still in 2023 with a simple mission to help our clients to evidence better outcomes for their consumer customers under the FCA Consumer Duty, notably the sustainability of debt remedies like IVAs and Debt Management Plans (DMPs).

We work with creditors, debt buyers, debt advisory firms, creditor voting agents and personal insolvency practices, including their funders. Whilst supporting clients with regulatory compliance across a range of regulated products, our core business is centred on IVA and DMP portfolios.

Our ethos:

- Integrity in all that we do

- Data-driven

- Technology enabled

- Pragmatic and commercial

- Strong Social Values

www.consumerdutyservices.com

Media contact to kevin@consumerdutyservices.com or 07980 859994