On 28 August 2024, the Accountant in Bankruptcy (AiB) published the Scottish Statutory Debt Solutions statistics for the financial year 2023-24. Overall, there were 8,082 personal insolvencies in Scotland in 2023-24, 1% more than in the previous financial year 2022-23.

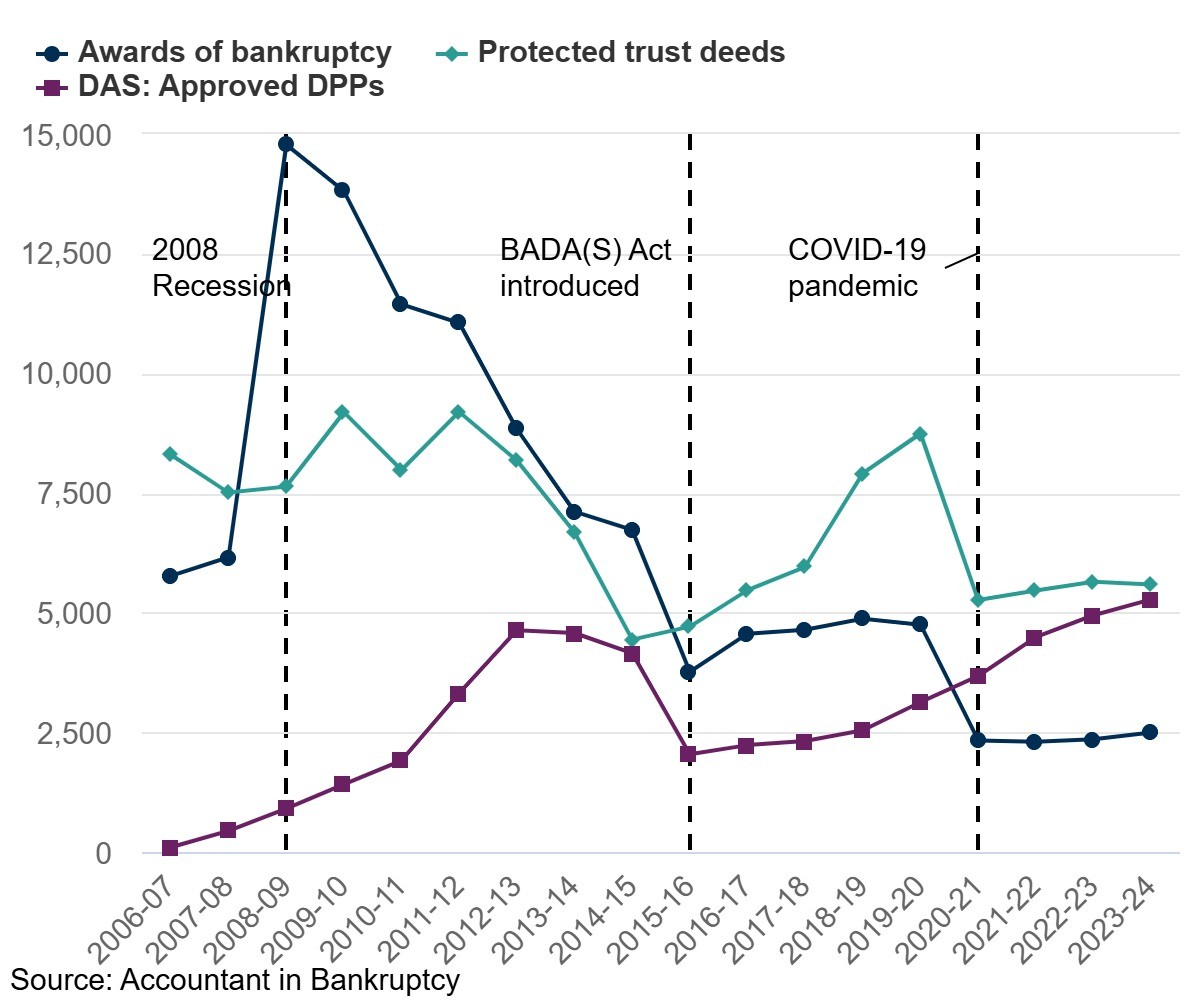

In this Blog we are looking at the sustainability of DPPs under DAS, aligned with the growth in take-up over recent years following regulatory changes implemented in 2019 and COVID. There has been a marked fall in Protected Trust Deeds (PTDs) in that period (see graph below). Meanwhile approved DPPs have risen steadily from 2015-16.

There were 16,721 active DPPs at the start of 2023-24 a 9.3% increase on the previous year. There were 18,570 at the end of the financial year, an increase of 11.1%. Interestingly, only 6.4% were joint applications, which is materially different from DMPs in England & Wales. Single debt cases are also allowed, though there were only 41 in the period.

Relative to DMPs operational in England & Wales, this is a small number. These numbers are, by contrast, in the public domain. Trade bodies like the DEBT MANAGERS STANDARDS ASSOCIATION LIMITED are trying to improve the transparency of DMP data across the UK. CP24/19 (RegData changes for debt solution providers) and the Product Sales Data (PS24/3) should improve the collation of DMP data from the end of 2025. Work is needed in the interim period.

Since the DAS (Scotland) Amendment Regulations 2018 came into force on 4 November 2019, creditors receive a minimum of 78% of debt owed to them from debtors on new DPPs approved (after DAS Administrator and payment distributor fees). Prior to this, the minimum was set at 90%. In 2023-24, £41.2m was repaid to creditors. Dividend is an important consideration. This was a key area of discussion when Statutory Debt Repayment Plans (SDRPs) were consulted on by HM Treasury before The Insolvency Service absorbed this in their personal insolvency reform work, which is ongoing. Creditor voting was a factor in this along with the impact on someone's credit file in terms of how distributions were recorded.

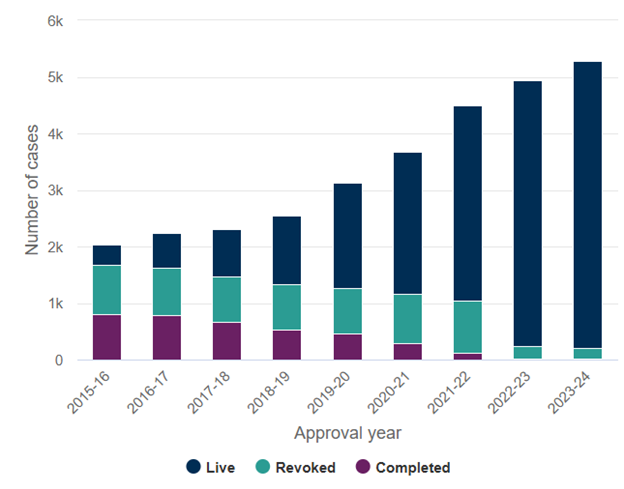

Consumer Duty Services is interested in the sustainability of these Scottish debt remedies when compared to the survival rates of IVAs and DMPs in England & Wales. In particular, we have featured the 3-year survival rate of DPPs in the headline graph, suggesting that 75% is around the norm with a cost-of-living crisis ongoing.

The Debt Arrangement Scheme (DAS) is a statutory debt management solution administered by the AiB. Under the DAS, debtors commit to a Debt Payment Plan (DPP), enabling them to repay their debts based on their disposable income. Throughout the duration of the DPP, debtors are protected from any creditor actions to recover the debt.

There were 5,278 debt payment programmes (DPPs) under Debt Arrangement Scheme (DAS) approved in 2023-24, compared with 4,947 granted in 2022-23, an increase of 6.7%.

Aside from the AiB (889), the major providers were Carrington Dean (1,805), Harper McDermott Ltd (1,481) and StepChange Debt Charity (889).

A DPP reaches completion when the debt in the programme has been paid in full. There were 1,826 completed DAS DPPs in 2023-24, a 4.8% decrease when compared with 1,918 in 2022-23

The total debt included in live DPPs has increased from £357m to £391m by 31 March 2024

In 2023-24, around £50.3m was repaid through DAS, a 7.2% increase when compared with £47m repaid in 2022-23

The survival rate for a DPP three years after approval has been increasing since 2015-16 from 66% to 74% in 2021-22

Since DAS was introduced, just over 53,500 DAS DPPs have been approved. Looking at each DAS case it can be established whether it has been completed, revoked or remains live and ongoing.

Aligned with the FCA Consumer Duty, the outcomes of DPPs are very material and are a useful metric to consider for DMPs in England & Wales in terms of survival rates for the plans that are intended to be long-term debt remedies rather than just transitional plans, where changes in circumstance are expected. Intelligible debt advice communications (i.e. suitability letters) need to clearly state a customer's objectives and whether a remedy is transitional or a mechanism to clear all qualifying debts alongside any priority debts (if applicable).

Revocations appear to be more meaningful from the third year of the DPP.

DAS Table 3 is a useful reference point with regard to median DPP expected durations and actual durations.

Conclusions

As Consumer Duty Services begins to look at sustainability modeling of DMPs alongside its more mature work with the sustainability of IVAs in England & Wales, it is interesting to look at how a statutory 'repayment in full' debt remedy could operate, involving creditor voting, better credit reporting and sustainability modeling over different time intervals.

I am attending the next Interim Working Party (IWG) update at the FCA's offices on 23 September 2024. The Credit Information Market Study report should be important in terms of the accurate reporting of various debt remedies on someone's credit file. This can be an issue for both DPPs and DMPs.

DMP survivability could become a key factor in the Financial Conduct Authority CONC 8 review starting in early 2025. The new RegData returns proposed under CP24/19 for debt management companies (DMCs) in 2025 will refine how DMP attrition reporting is collated.

Product Sales Data (PSD under PS24/3) will include quarterly reporting of DMPs by creditors, which should highlight attrition rates and enable better MI and collaboration between the creditor and debt solution sectors, aligned to PS24/2 (Borrowers in Financial Difficulty) from 4 Novembers 2024.

The AiB report is fairly detailed across all statutory debt remedies and worth a review if you engage with Scottish residents. Yvonne MacDermid OBE has been looking at the ongoing suitability of debt remedies in Scotland. I believe that there is a lot to learn from DAS and how it has evolved from the early days.

Kevin Still - Director of Consumer Duty Services - kevin@consumerdutyservices.com